Ico Rating

-

4.7 /5

4.7 /5 -

A

A -

9.4 /10

9.4 /10 -

4.9 /5

4.9 /5 -

5 /5

5 /5

What is KESS?

KESS is a digital currency designed exclusively for users in Kenya. Instead of the shilling, Kenyans can use the KESS cash to buy and sell cryptocurrencies, such as BTC, ETH, XRP, LTC, USDT etc.

KESS follows the same financial background as shilling and can thus be exchanged based on the same value. This means that one KESS equals one KES (1 KESS = 1 KES).

KESS transactions can settle in seconds worldwide. All day, every day. In contrast, Legacy payments can take multiple days to settle and don’t move after hours, on weekends, or during holidays.

What’s in it for you? With KESS, you get to:

Conduct instant P2P transactions in Kenya.

Peer-to-peer (P2P) payments refer to the direct transfer of funds from one individual to another without intermediaries like banks or payment processors.

Earn on a monthly basis.

Earn monthly returns through staking. Users benefit from passive income, while businesses and DeFi protocols gain a reliable liquidity base.

Eliminate Remittance Friction

With KESS, cross-border payments are handled digitally on-chain, bypassing the queues and manual forms typically required by banks.

KESS Features

Below is a detailed overview of the primary features that define KESS. These features distinguish KESS as a secure, transparent, and efficient digital currency for everyday transactions and broader financial applications.

1:1 Fiat Peg to the Kenyan Shilling

Each KESS token is redeemable for exactly one Kenyan Shilling. This peg structure ensures price stability and reduces volatility. For every KESS token minted, an equivalent amount of Kenyan Shillings (or KES-denominated assets) is held in reserve by a regulated financial institution.

Seamless On/Off-Ramps

KESS supports common mobile money systems (e.g., M-Pesa) and digital wallets, reducing friction between fiat and crypto. With 24/7 Accessibility - KESS transactions finalize in minutes (or seconds) depending on the network.

Interoperability and Use Cases

Users can send KESS to friends or family quickly and at low cost—ideal for daily transactions like splitting bills or repaying loans. Users can send KESS to friends or family quickly and at low cost—ideal for daily transactions like splitting bills or repaying loans.

Problems and Challenges

KESS aims to address several key challenges within the Kenyan economy through streamlining payments, boosting financial access, and catalyzing innovation in Kenya’s rapidly evolving fintech landscape.

Price Volatility in Digital Assets

Traditional cryptocurrencies like Bitcoin or Ethereum often experience significant price swings, making them unsuitable for everyday payments or as a store of value.

Why Volatility is Problematic

- Stability is critical in instilling confidence, promoting financial inclusion, and fostering innovation in the Web3 sector.

- Unsuitability as a Medium of Exchange - Extreme price movements discourage using cryptocurrencies for common purchases.

- Merchant Risk - Merchants accepting highly volatile coins risk losing value if the price drops soon after a sale.

- Managing budgets or forecasting revenue becomes harder when the underlying currency’s value is constantly fluctuating.

High Fees and Slow Transactions

Remittances into Kenya can incur high fees and extended processing times, especially via traditional banking corridors and money transfer operators.

Limited Financial Inclusion

Many Kenyans remain underbanked or unbanked, lacking access to affordable loans, savings products, or efficient remittance channels.

Fragmented Digital Payment Ecosystem

Users often need multiple platforms (e.g., banks, mobile money operators, international remittance channels) to perform various types of transactions.

How KESS Addresses These Challenges

KESS aims to provide a reliable and stable digital currency for everyday transactions, cross-border payments, remittances, and other use cases in Kenya. This stability fosters confidence among users and investors, promoting the adoption of KESS and contributing to the growth of the digital economy in Kenya.

Stable, Local Currency Peg

Reduces volatility and makes digital transactions feel more familiar and trustworthy to Kenyan users.

Lower Fees & Faster Payments

Leverages efficient blockchain networks, reducing transaction costs and settlement times.

Financial Inclusion

Accessible to anyone with a mobile phone or internet connection, bridging the gap for the underbanked.

Digital Onboarding & 24/7 Availability

Less reliance on brick-and-mortar banks, cutting down queues and wait times for transactions and account services.

Our Products

We created a fully collateralized digital currency 1:1 backed by Kenyan Shillings and KES-denominated assets. Users can seamlessly deposit and withdraw funds to or from their bank or mobile money account.

KESS Stablecoin

Because KESS is fully backed by fiat reserves, it does not follow the typical “ICO” or “token sale” structure used by many crypto projects. Instead, tokens are created on-demand when users deposit Kenyan Shillings (KES), and they are burned when tokens are redeemed for fiat.

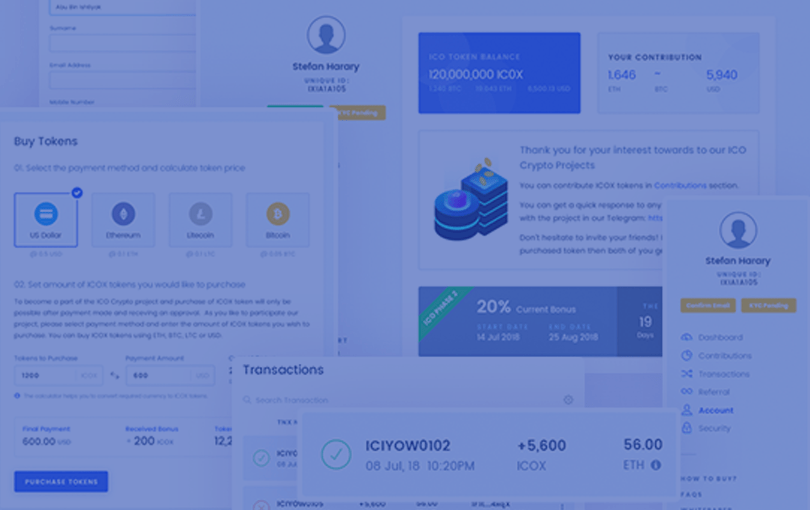

Sales Information

| Public Sale Starts | 31st Dec 2024 12:00 GMT |

| Token Value | 1 Kenya Shilling = 1 KESS |

| Accepted | M-pesa, Bank Transfer |

Token Sale Stage

KESS employs an on-demand issuance model where tokens are minted and burned according to users’ direct fiat deposits and withdrawals, rather than a one-time public sale. This structure ensures full collateralization, stable value, and a transparent reserve underpinning every token. The sales process is straightforward—deposit Kenyan Shillings, complete KYC, and receive an equivalent amount of KESS, which can then be transacted, spent, or redeemed at any time.

Register & Buy KESS Now Minimum Purchase: 500 KESSKESS Tokens

KESS focuses on delivering a trusted, compliant, and convenient digital currency specifically tailored for the Kenyan market.

Read the Whitepaper

The document delves into the technological infrastructure, risk mitigation strategies, and regulatory considerations, showcasing KESS as a transformative tool in bridging traditional and decentralized finance for Kenya's citizens and businesses.

The roadmap to success

What are our major goals?

The KESS roadmap outlines phases from concept to global expansion, focusing on compliance, adoption, DeFi integration, and scalability.

Research & White Paper: Detailed analysis of market needs, technological infrastructure, and regulatory frameworks.

- Concept Validation: Engage with stakeholders, including financial institutions, regulators, and potential users, to refine the vision.

- Technology Selection: Choose a blockchain platform prioritizing scalability, cost-efficiency, and security (e.g., Binance Smart Chain).

- Smart Contract Design: Develop and audit smart contracts for minting, burning, and token transfers.

- Reserve Infrastructure: Establish partnerships with regulated financial institutions to manage KESS reserves.

- Testnet Deployment: Launch a functional prototype on a blockchain testnet for debugging and stress testing.

Public launch and crowd-sale starts - 1st Januray & Token distribution will commence immediately.

Liquidity Partnerships: Collaborate with financial service providers, digital wallets, and exchanges for seamless integration.

Education and Outreach: Conduct awareness campaigns targeting individuals and businesses about the benefits of KESS.

Ongoing Audits: Maintain regular audits to uphold trust and ensure financial backing.

FAQs

Below we’ve provided a bit on stable coins, KESS, cryptocurrencies, and few others. By addressing these FAQs, KESS aims to provide comprehensive information and support to users, ensuring a seamless and secure experience with Kenya’s stablecoin solution.

What is KESS?

KESS is a stablecoin pegged to the Kenya Shilling (KES), designed to provide a secure, stable, and efficient means of digital transactions and value storage.

How does KESS maintain its stability?

KESS maintains its stability by being fully backed by reserves of Kenya Shillings held in secure, transparent, and audited accounts. Each KESS token is equivalent to one Kenya Shilling.

Who can use KESS?

KESS is designed for individuals, businesses, and institutions looking for a stable digital currency solution in Kenya and beyond. Whether you’re making everyday transactions, remittances, or holding digital assets, KESS offers a reliable alternative.

How can I get KESS?

You can acquire KESS through our official website, participating exchanges, and authorized agents. Detailed instructions for purchasing KESS can be found on our "Get KESS" page.

Which of us ever undertakes laborious?

Once ICO period is launched, You can purchased Token with Etherum, Bitcoin or Litecoin. You can also tempor incididunt ut labore et dolore magna aliqua sed do eiusmod eaque ipsa.

How do I use KESS for transactions?

KESS can be used for a variety of transactions including payments, remittances, and online purchases. Simply transfer KESS to the recipient's wallet address, and the equivalent amount in Kenya Shillings will be transferred.

Can I convert KESS back to Kenya Shillings?

Yes, you can convert KESS back to Kenya Shillings at any time through our platform or authorized partners. The conversion rate is always 1 KESS = 1 KES.

Is it safe to use KESS?

Yes, KESS uses advanced security measures and is fully backed by reserves in Kenya Shillings. Our platform undergoes regular audits to ensure the highest level of security and transparency.

What blockchain does KESS use?

KESS is deployed as a BEP-20 token on the BNB Smart Chain that extends ERC-20, the most common Ethereum token standard.

How can I check the reserves backing KESS?

We provide regular audit reports and real-time transparency on the reserves backing KESS.

What happens if there is a technical issue with KESS?

Our support team is available 24/7 to assist with any technical issues. You can contact us through our "Support" page for immediate assistance.

Can I earn interest on KESS holdings?

Currently, KESS does not offer interest on holdings. However, we are exploring future possibilities for additional financial services.

How do I contact KESS support?

You can reach our support team through the "Contact Us" page on our website, via email at [email protected], or through our social media channels.

Where can I find more information about KESS?

For more detailed information, you can visit our "About Us" page, read our whitepaper, or follow our blog for the latest updates and news.

How can I provide feedback or suggestions?

We value your feedback and suggestions. You can submit them through our "Feedback" page or contact us directly via email.

What wallets support KESS?

KESS is compatible with various digital wallets that support BEP-20 tokens.